straight life policy develops cash value

If the insured lives to the age of 100 the insurance company pays the owner the face amount equal to cash value. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Its premium steadily decreased over time.

. This is a straight life annuity that starts paying you back as soon as you acquire it. Also known as whole or ordinary life. Which statement is NOT true regarding a Straight Life policyA.

It usually develops cash value by the end of the third policy year. It has the lowest annual premium of the three types of whole life policies A. Qualify Today To Sell Your Policy for Cash.

See if you qualify in under 10 Minutes. It usually develops cash value by the end of the third policy year. Rather than being seized as a collection measure on defaulted loans the cash value in your straight life policy can be leveraged to repay any creditors you owe.

Time in response to its growing cash value. A straight life policy has a level premiumit wont change over the life of your policy. A man decided to purchase a 100000 Annually Renewable Term Life policy to provide additional protection until his children finished college.

Dont sell lapse or cancel until you speak with us. Get an instant estimate. Straight Life Annuities Defined Annuities are a type of insurance contract.

Ad Find out what your policy is worth. Get an instant estimate. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

We show you how to get the most out of your life settlement. Straight life policy develops cash value. However if the insured dies prior to the policy maturity date the death.

The cash value component serves as a living benefit for policyholders from which they may draw funds. It usually develops cash value by the end. He discovered that his policy A.

A straight life insurance policy can also build cash value over time. We show you how to get the most out of your life settlement. Dont sell lapse or cancel until you speak with us.

It usually develops cash value by the end of the third policy year. They pay a steady income to retirees for the rest of their life. See if you qualify in under 10 Minutes.

The life insurance net cash value is what the policyholder or their. Term life policy While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. Ad Find out what your policy is worth.

Ad Cash in your life insurance policy. A straight life annuity ensures that the annuitant who is the person entitled to the income benefits of an annuity will continue to receive payments for life. Any type of life insurance may qualify including term whole universal and more.

Straight refers to the. With the cash value of life insurance a percentage of your premium payment goes to your cash value account. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole Life policie.

Ad Cash in your life insurance policy. We show you how to get the most out of your life settlement. If you select the straight life annuity payout option.

The face value of the policy is paid to the insured at age 100. Here are the advantages of cash value life insurance. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest.

This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the. The term straight refers to the whole life insurance policys premium structure. 1straight life-prem and face amt death benefit remain level to age 100 or death which ever comes first 2limited payment- premium payments are for.

Which statement is NOT true regarding a Straight Life policy. The term straight life single-premium immediate annuity refers to the same thing. B Fees required by the company to provide the coverage and c Cash value which is an investment account associated with the life insurance policy.

Plr He May 21 2022 Edit. Straight life insurance is. The cash value of whole life insurance can accrue slowly or more rapidly depending on the policy design and also on the age and health of the insured.

Most of the time. The face value of the policy is paid to the insured at age. Any type of life insurance may qualify including term whole universal and more.

The rate of return will typically be large enough that.

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

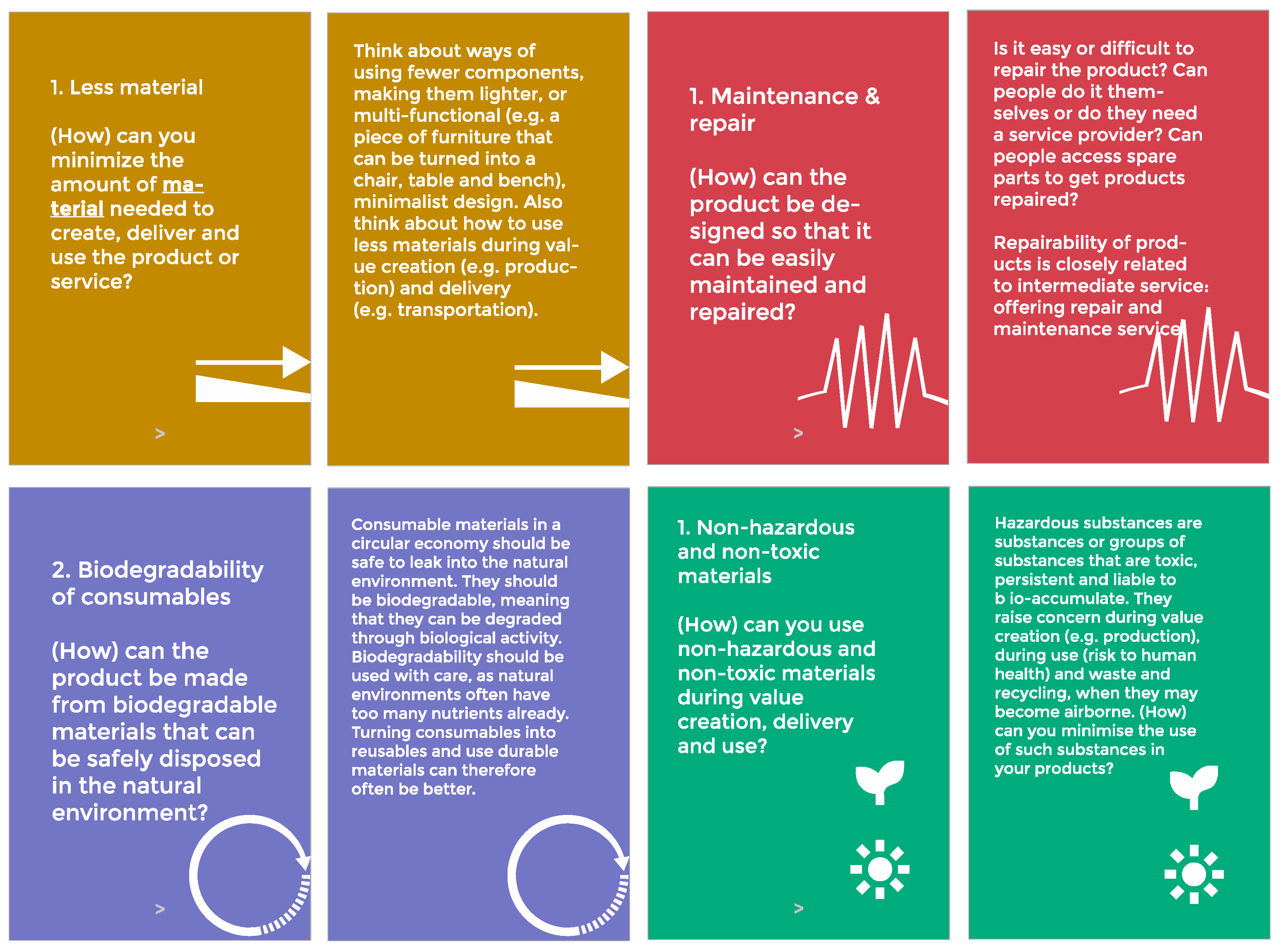

Sustainability Free Full Text A Tool To Analyze Ideate And Develop Circular Innovation Ecosystems Html

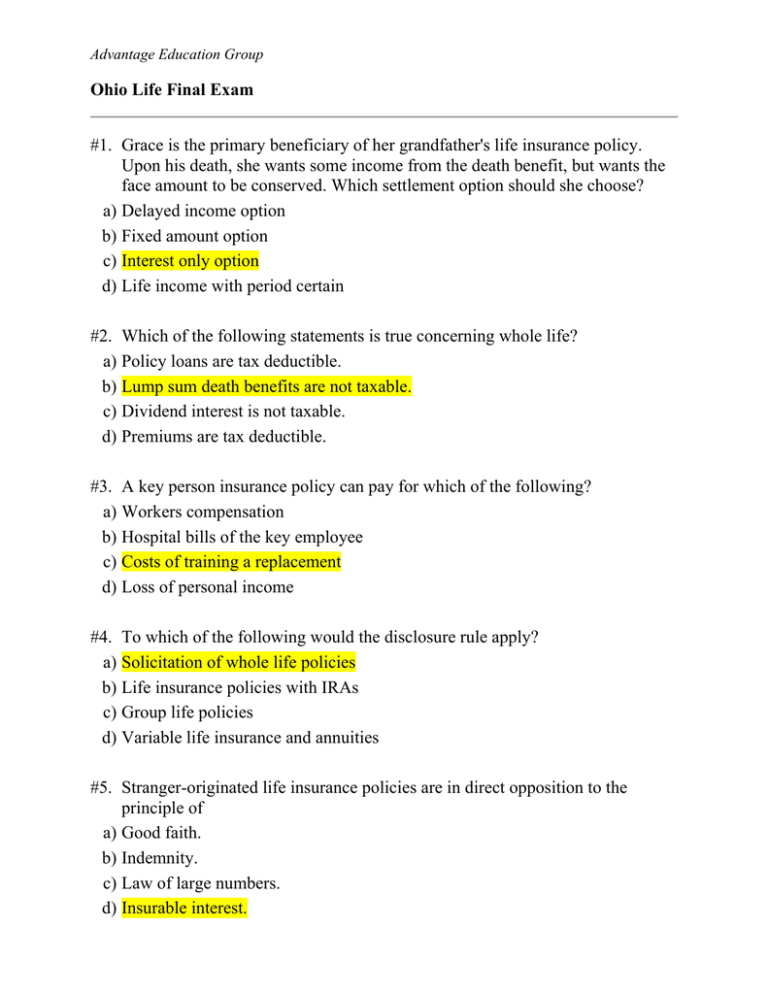

Life Insurance Flashcards Quizlet

Life Insurance Flashcards Quizlet

National Grid 20 F 2020 Redacted Combined Document

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Life Insurance Flashcards Quizlet

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Straddle_Strategy_For_Market_Profits_Jun_2020-02-4f0d46de5d5e4635a47a80a752626d6e.jpg)

Understanding A Straddle Strategy For Market Profits

Chapter 7 Premium Foundations Loss Data Analytics